A Complete Manual to Determining One's True Mortgage Payment

Navigating through the landscape of home financing might be overwhelming, particularly when it comes to determining your actual mortgage payment. A lot of homebuyers focus solely on the principal and interest that they pay monthly, but it's important to note that a mortgage involves various elements that can accumulate notably over the long term. Grasping these elements is essential to making knowledgeable financial decisions and ensuring you are equipped for the commitments of being a homeowner.

In this guide, we will guide you through the essential steps to determine your true mortgage payment. From using a mortgage calculator to considering taxes, insurance, and other potential costs, you will gain a comprehensive understanding of the monthly expenses you can expect. This information will enable you to budget effectively and choose the right mortgage for your unique situation. Whether you are a first-time buyer or seeking to refinance, knowing calculate your mortgage payment accurately is a critical ability that can lead to savings and anxiety in the long run.

Grasping Mortgage Payment Elements

While figuring out your true mortgage payment, it is essential to grasp the multiple parts that make up your overall payment. Typically, a mortgage payment consists of 4 key elements: the principal, the interest, property taxes, and insurance, collectively termed as PITI. Each of these components plays a key role in determining what you will pay each month.

The principal is the initial loan amount to buy the home, while interest is the expense of taking out that money, measured as a fraction. This interest rate can fluctuate depending on your credit score, current market trends, and the type of mortgage you choose. It is important to understand how these two components influence one another because as you pay your mortgage, a portion goes toward paying down the principal, and the leftover portion covers interest.

Along with principal and interest, mortgage payments often include property taxes and homeowners insurance. Property taxes are generally determined based on the value of your home and can change. Homeowners insurance covers your property and may be required when applying for a mortgage. When calculating your true mortgage payment, it is vital to include these components to understand the overall financial responsibility involved in homeownership.

Utilizing a Mortgage Estimator Effectively

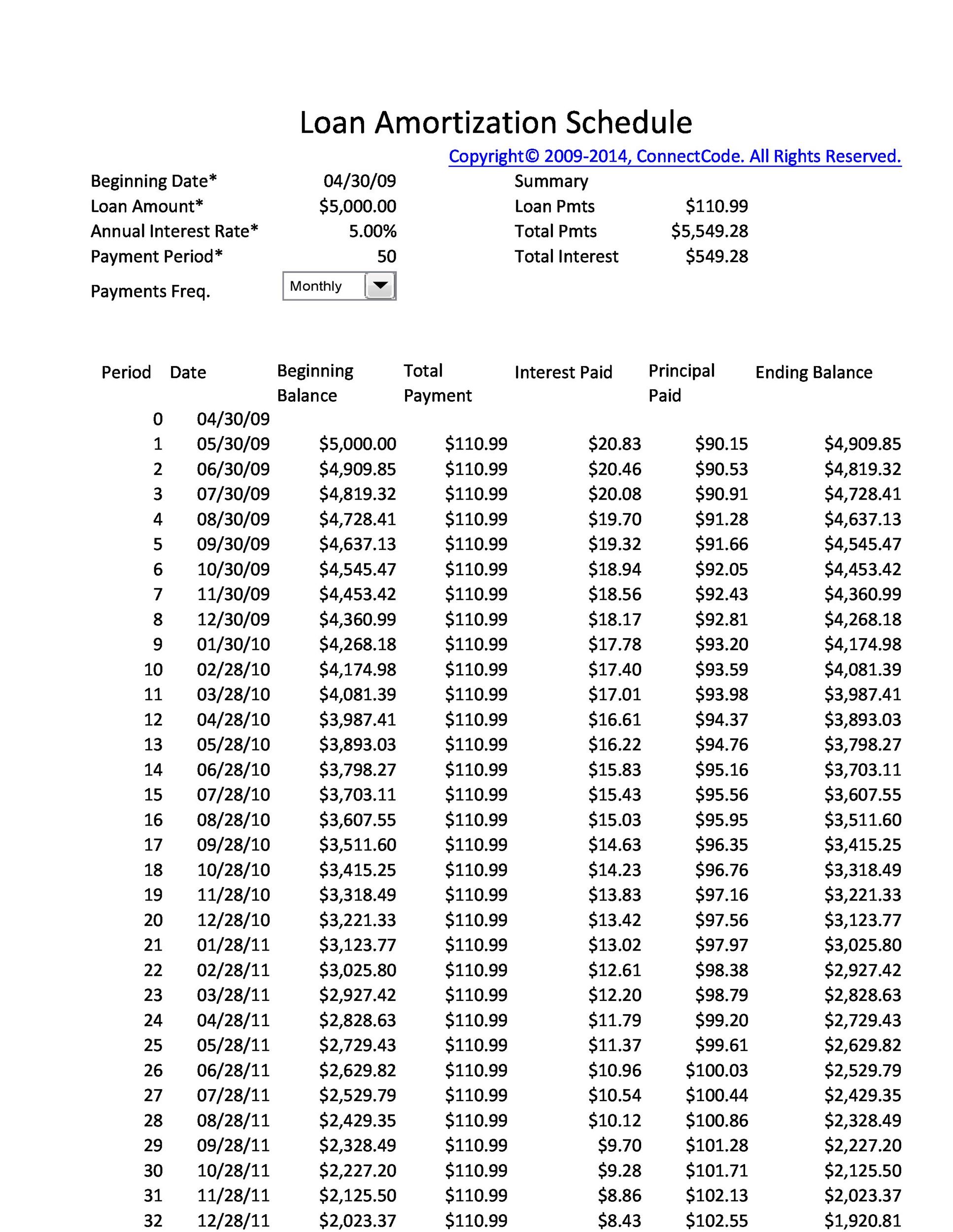

A mortgage calculator is an essential resource that makes easier the process of estimating your real mortgage payment. To use it efficiently, begin by collecting all the necessary data. This comprises the buying price of the property, your down payment sum, the loan term in years, and the interest rate. Entering these details accurately will give you with a clear picture of your potential monthly payment and the overall cost of the loan.

Once you have your basic calculations, investigate additional features of the home loan estimator. Many tools have options to factor in property taxes, homeowner's insurance, and private mortgage insurance. By including these elements, you can gain a more comprehensive understanding of your total monthly housing costs. Change the inputs to see how changes in the down payment or interest rates impact your payment, allowing you to make educated decisions about your mortgage options.

Lastly, don’t disregard the power of different loan types. Using the calculator, compare fixed-rate and adjustable-rate mortgages to see which most fits your financial situation. Each choice can significantly change your long-term expenses and monthly obligations. By employing a mortgage calculator efficiently, you'll equip yourself with the necessary insights for a confident and wise home purchase.

Typical Pitfalls to Steer Clear Of

One typical error people make when calculating their mortgage payment is neglecting additional costs beyond the principal and interest. Many buyers focus only on these two components, forgetting about taxes, insurance, and potential homeowners association fees. These expenses can significantly affect the entire amount you need to budget for each month, leading to a misunderstanding of what you can truly afford.

Another frequent error is not comparing around for the best mortgage rate. Many borrowers settle on the first offer they receive, believing it's the best available. However, HipoteCalc can vary greatly between lenders, and even a small difference can lead to considerable savings over the life of the loan. Using a mortgage calculator to analyze different rates and terms can help in arriving at an informed decision that fits your financial situation.

Lastly, failing to factor in the influence of changing interest rates over time can lead to unexpected challenges. Borrowers with adjustable-rate mortgages might not fully grasp how rate adjustments will alter their payments in the future. It's crucial to factor in potential fluctuations when determining your long-term budget and to use a mortgage calculator that incorporates these scenarios for a clearer view of your financial obligations.